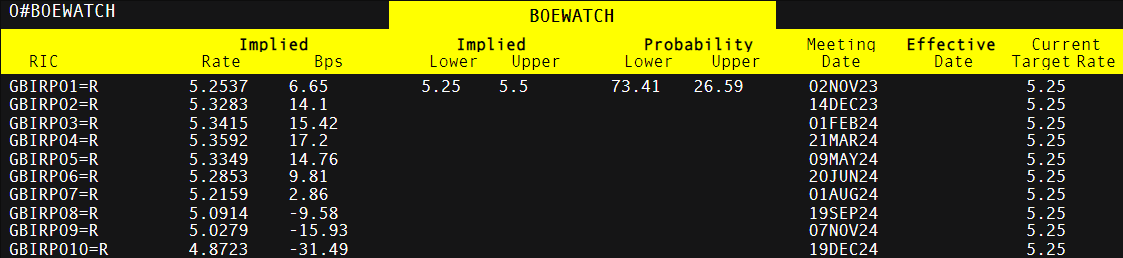

BANK OF ENGLAND HOLDS INTEREST RATES STEADY AT 5.25%

- The monetary policy committee narrowly decided to hold (5-4)

- Disinflation is expected to continue but growth forecasts for H2 are likely to be weaker

- BoE hints at a potential peak in interest rates as the bank stated it will be “sufficiently restrictive for sufficiently long” to get inflation to target.

Covered in yesterday’s report, UK CPI posted the most convincing drop in prices witnessed this year as both the headline and core measures of inflation printed lower than consensus estimates. The biggest downward contributions came from accommodation services and food, where prices rose slower than in August of 2023.

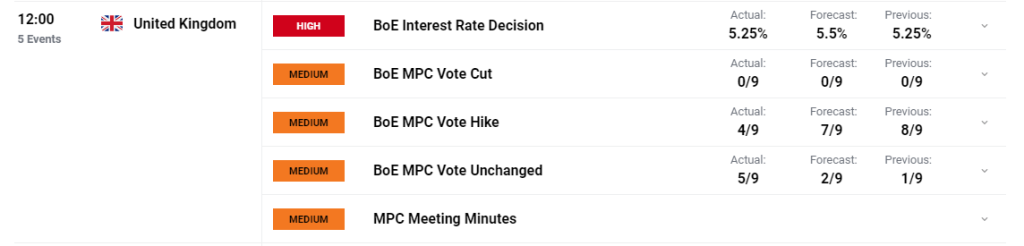

The progress observed in inflation sparked a massive rerating of UK interest rate hikes, seeing the likelihood of a 25-bps hike move from just under 80% before the data to 50% in the moments thereafter. However, the war on hot prices is far from over with the UK experiencing the highest level of inflation among its peers in developed nations.

In the aftermath of the BoE’s decision today, rates markets still entertain the possibility of another rate hike before year-end, while pricing in a potential rate cut only at the end of next year.

Implied Interest Rate Probabilities

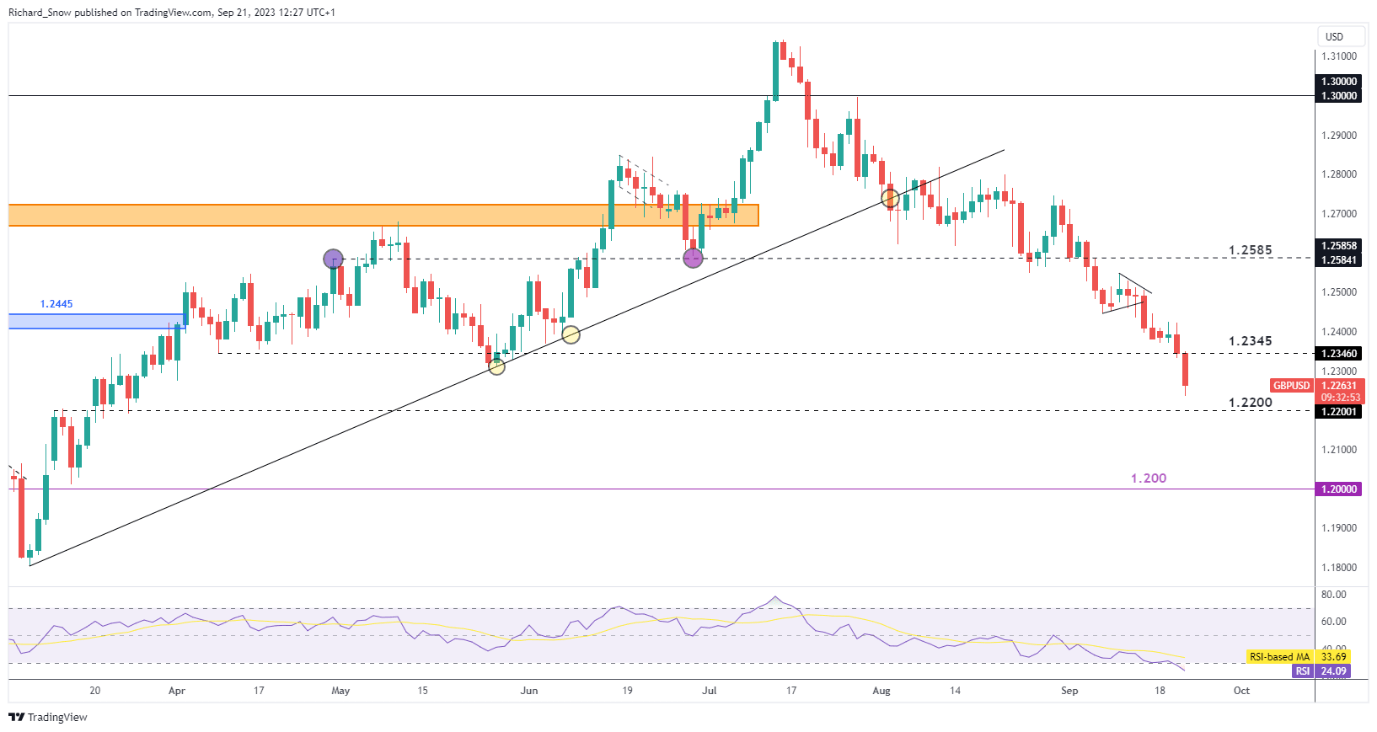

IMMEDIATE MARKET REACTION – STERLING OFFERED

With plenty of uncertainty around what was nearly a 50/50 decision, it’s unsurprising to see a notable move lower in sterling. GBP/USD continued the longer-term selloff, breaking beneath 1.2345 with ease, now eying a potential test of 1.2200. However, the BoE catalyst now places the pair in oversold territory, meaning a minor pullback after the dust settles would not go completely against the run of play.

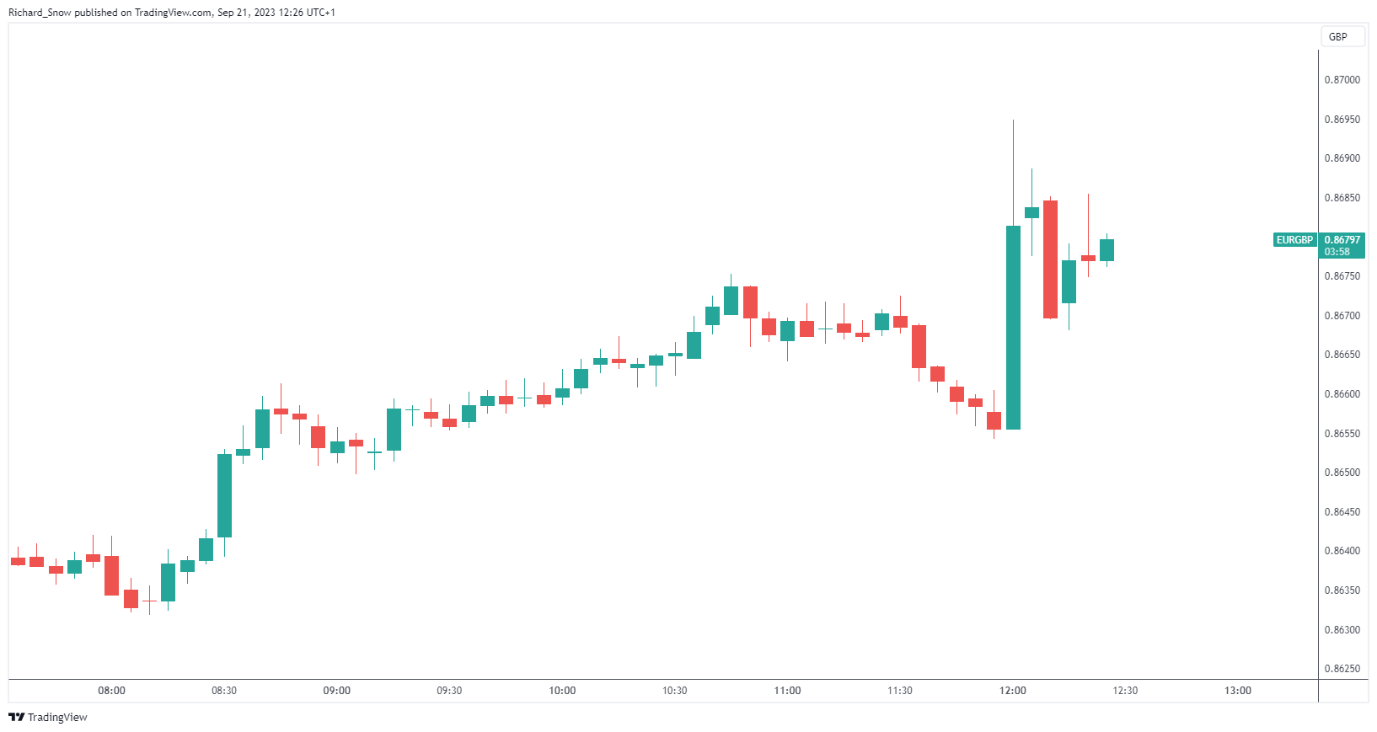

EUR/GBP tested channel resistance yesterday after the CPI report, paving the way for today’s news to follow through with added momentum. EUR/GBP surged above channel resistance at 0.8650, which remains the level to analyze on a daily candle close, if the bullish direction has the potential for an extended move higher.

EUR/GBP 5-Minute Chart