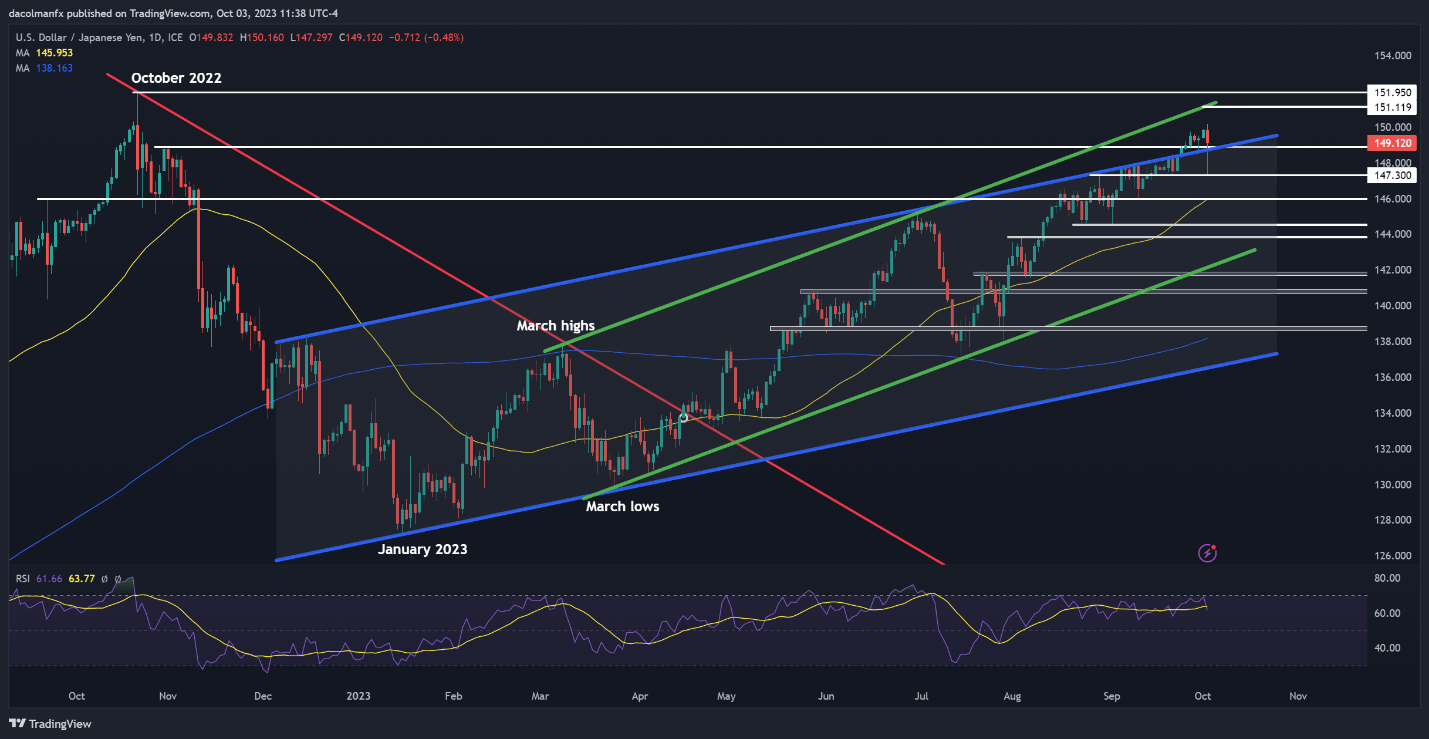

USD/JPY OUTLOOK:

- USD/JPY briefly breaks above 150.00, but then pulls back sharply on signs that the Japanese government has stepped in to support the yen in currency markets.

- Any FX intervention measures will not be enough to support the yen on a sustained basis.

- As long as the underlying fundamentals do not change, the USD/JPY will remain in an uptrend.

USD/JPY has been on a bullish tear in 2023, up more than 14% since January, boosted by soaring U.S. Treasury yields on the back of hawkish Fed policy. Earlier on Tuesday, the pair pushed above 150.00, the highest exchange rate since October 2022, but was quickly smacked lower in a strong knee-jerk reaction, signaling that the Japanese government may have stepped in to stem the yen’s slide.

While Tokyo’s FX intervention could provide brief respite to the yen and curb speculative activity from time to time, it will not alter the currency’s depreciatory trajectory as long as the underlying market fundamentals remain the same. Monetary policy divergence between the FOMC and the Bank of Japan, for instance, will continue to be a tailwind for the U.S. dollar.

USD/JPY TECHNICAL CHART

When considering the bigger picture, Japanese authorities have few options available to counter the sharp rise in U.S. rates driven by U.S. economic resilience and the Federal Reverse’s stance. Over the course of this week, the U.S. 10-year yield has surged past 4.75%, reaching its highest level since August 2007, while the Japanese 10-year note has held steady around 0.76%. These dynamics and yield differentials clearly favor USD/JPY strength.

USD/JPY BULLISH

Data provided by

86% of clients are net short.

| CHANGE IN | LONGS | SHORTS | OI |

| DAILY | -41% | -4% | -11% |

| WEEKLY | -42% | 0% | -8% |