USD/JPY TECHNICAL ANALYSIS

USD/JPY extended its advance on Thursday, soaring nearly 0.8% to 142.93, boosted by rising U.S. Treasury yields after key Fed officials, including the FOMC chairman, voiced support for additional interest rate increases later this year as part of the ongoing fight to restore price stability and bring inflation back to the 2.0% target.

Bulls have dominated the market in 2023, with the pair up more than 2.5% in June and about 9% since the beginning of the year. For now, there is no indication that they will let up any time soon, though caution is warranted, as Japanese authorities may soon step in to curb speculative activity in the forex space.

Looking at price action, USD/JPY has breached Fibonacci resistance at 142.50 following today’s rally, reaching its best levels since November 2022. If this breakout is sustained on a weekly basis, buying momentum could gather pace in the coming days, setting the stage for a move toward the psychological 145.00 mark.

Should the bullish scenario play out, traders need to exercise more restraint to avoid being caught wrong-footed in case of sizeable FX interventions. Last year, Japan’s Ministry of Finance began selling U.S. dollars to prop up the yen when the exchange rate flirted with ¥146.00 and ¥152.00.

Focusing on the downside, if USD/JPY fails to stay above 142.50 and starts to retreat, a pullback toward technical support at 140.80/140.50 is likely. While prices may establish a base around those levels before bouncing back, a breakdown could jeopardize the constructive view, emboldening sellers to challenge the 139.00 handle.

USD/JPY TECHNICAL CHART

AUD/JPY ANALYSIS

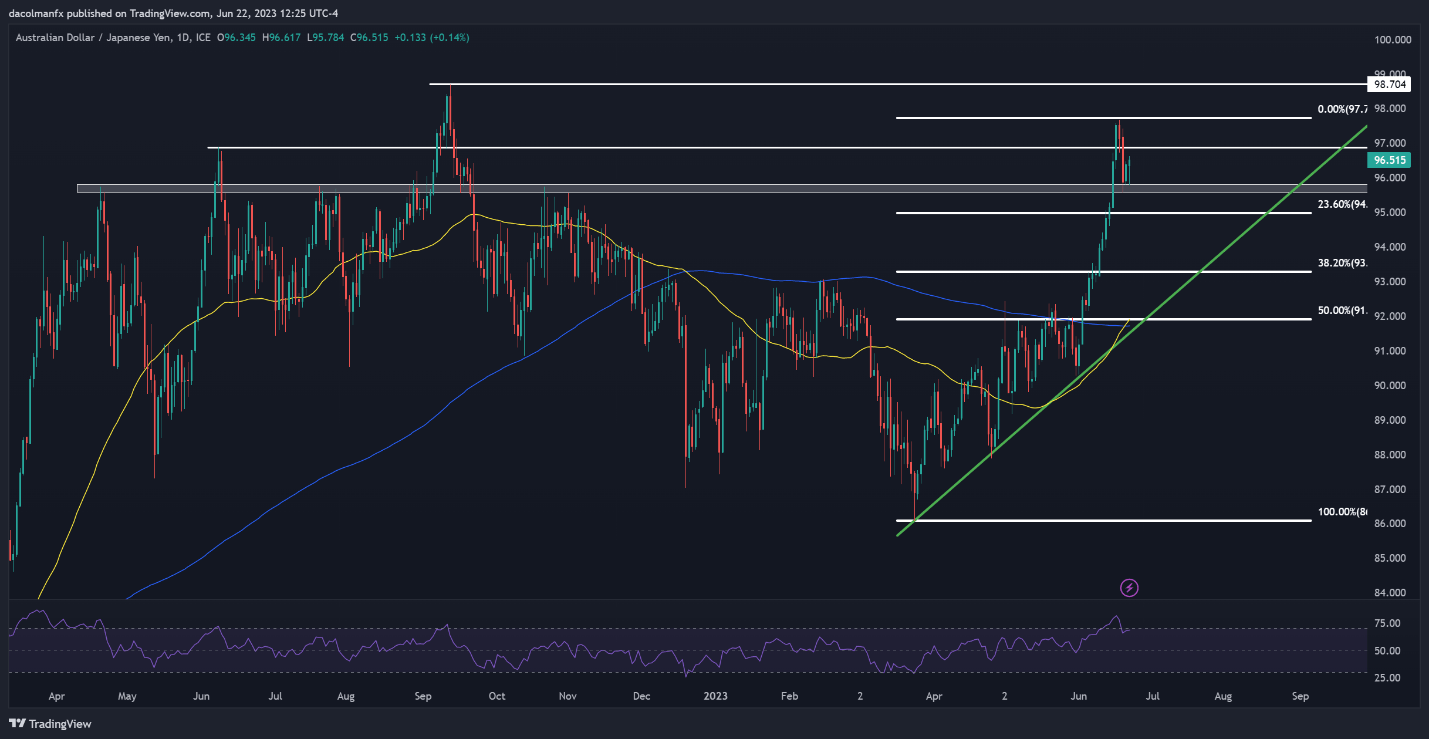

After rising almost vertically since late May and entering overbought territory, AUD/JPY set new multi-month highs around 97.70 a few days ago. However, the upward momentum has weakened amid a cautious mood in financial markets.

While RBA and BoJ’s monetary policy divergence can be seen as a positive driver for the Australian dollar, shifts in global sentiment may be a more important catalyst to watch. In this context, traders should keep a close eye on China’s economic activity. That said, if incoming data show that the growth profile of the Chinese economy is worsening, risk aversion could set in, bolstering the Japanese yen and triggering a deep AUD/JPY correction.

From a technical standpoint, AUD/JPY sold off earlier this week, but encountered support near 95.80/95.55. From those levels, the pair mounted a moderate rebound, but impetus appears to be stalling out on Thursday, a sign a fading buying interest.

We will have more clues on the outlook in the coming days, but if AUD/JPY extends its rebound, initial resistance lies at 96.85. Overcoming this ceiling could clear the way for a retest of the 2023 highs. Conversely, if sellers regain control of the market and push prices lower, support rests at 95.80/95.55, but a breakdown could bring further losses, with the next downside target at 94.97, followed by 93.27.

AUD/JPY BEARISH

Data provided by

75% of clients are net short.

| CHANGE IN | LONGS | SHORTS | OI |

| DAILY | 22% | -1% | 4% |

| WEEKLY | 34% | -1% | 7% |

AUD/JPY TECHNICAL ANALYSIS