- Crude oil prices find some support today giving CAD a boost

- Canadian balance of trade outperforms US report.

- Bull pennant looks ripe for a breakout but key Canadian and US data in store tomorrow.

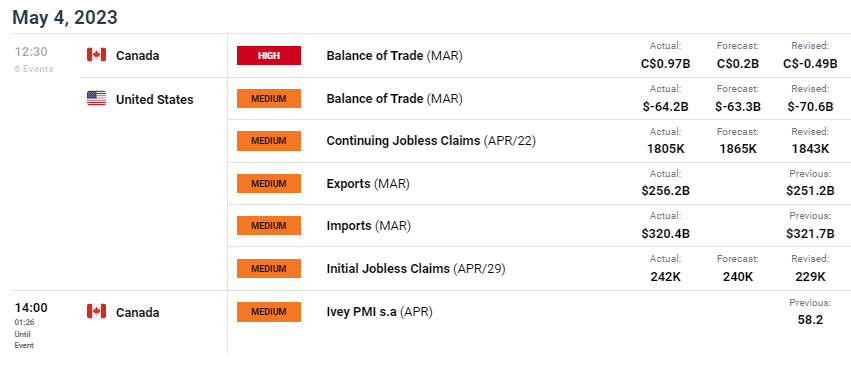

The Canadian dollar has been consolidating of recent after a major sell-off coinciding with declining crude oil prices. Concerns around a global economic slowdown have led to demand forecasts being revised while the ongoing banking crises has not allowed for commodity-linked currencies to prosper. Canada’s balance of trade report (see economic calendar below) beat estimates today (surplus) allowing for the loonie to find its footing against the USD while the US balance of trade figures slightly missed (deficit) in conjunction with a higher initial jobless claims print.

Today, the CAD has been stronger against the greenback despite the USD trading higher on the day with crude oil and the aforementioned balance of trade data providing support. Yesterday’s FOMC announcement erred on the dovish side of the equation and has led to a marginally softer dollar outlook as additional rate hikes have been priced out for 2023 by money market participants.

USD/CAD ECONOMIC CALENDAR

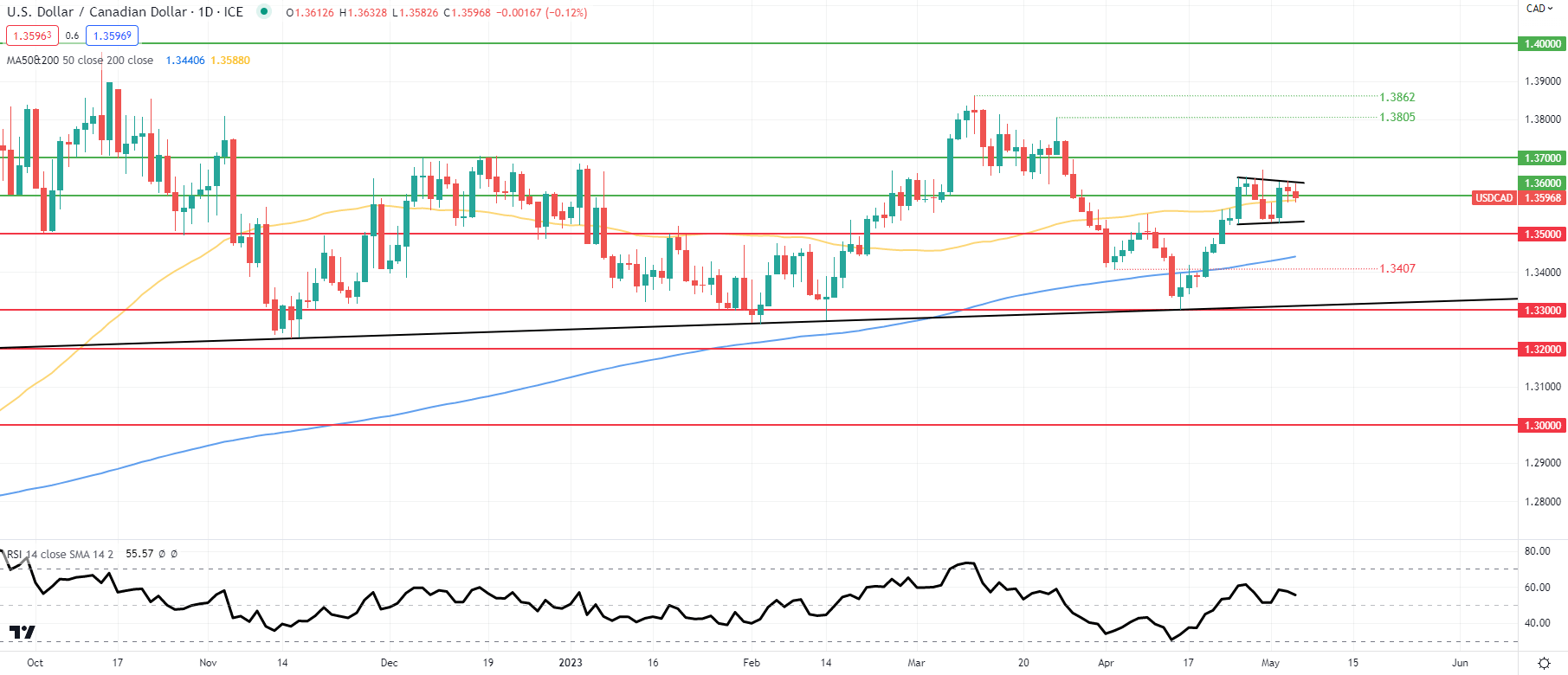

USD/CAD DAILY CHART

Daily USD/CAD price action is contained within a bull pennant type pattern (black), traditionally associated with a bullish continuation move from an upside breakout. I will be looking for a pennant resistance break and confirmation close possibly opening up the 1.3700 psychological handle. In contrast, a pennant support break could invalidate this pattern and expose the 1.3500 level once more.

Key resistance levels:

- 1.3700

- Pennant resistance

- 1.3600

Key support levels:

- 50-day MA (yellow)

- Pennant support

- 1.3500